Former Joseph Rowntree Foundation chief to spearhead COVID-19 recovery support for society in new role with Smart Data Foundry, the new name for Global Open Finance launching 21 February

- Focus on impact of ‘devastating’ late payments for SMEs

- Vital data for policymakers leading economic recovery

- NatWest Group, Sage, Equifax, FreeAgent and MoneyHub among partners

The causes and impact of late payments on small and medium sized businesses attempting to bounce-back from the global pandemic is to be the focus of a major new partnership involving Banks, FinTech, researchers and the UK Government, it was revealed today.

It will help the financial community engage in a nationwide COVID-19 recovery and policy in a similar fashion to how the science industry leveraged data to help steer people’s health through the worst of the COVID-19 emergency.

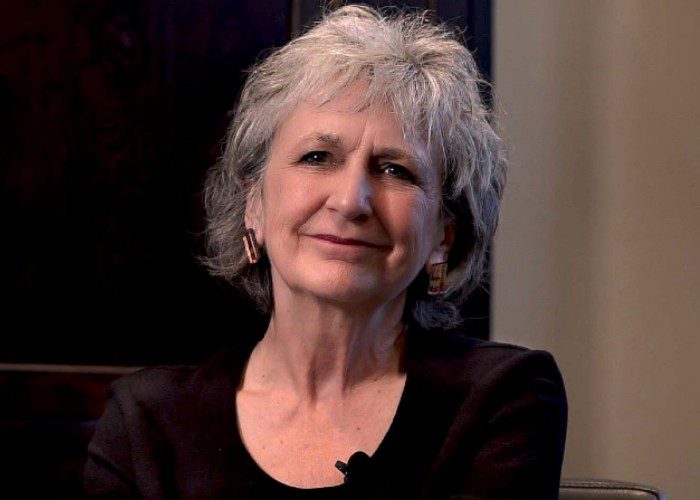

The drive by the Smart Data Foundry announced today will be led by its new chair, the widely respected peer Dame Julia Unwin, universally well-known as a senior leader committed to social justice.

She was the Chief Executive of the Joseph Rowntree Foundation for a decade until the end of 2016, and has had a long career working in government, within the corporate and voluntary sectors.

In her first major announcement since taking up her new role as Chair, Dame Julia said:

“We have started a movement within the financial services sector which is gaining momentum at pace. The science community has shown how important health data was to manage the pandemic. Our aim is to do the same for the economy by providing financial data.

“However, our collaboration will reach beyond Open Finance as we look at other significant challenges data can support with such as climate data and the transition to net-zero, addressing the Poverty Premium and supporting the intersection of finance and health.”

As part of the initiative Smart Data Foundry also announce new partnerships with Equifax, Sage Group, Moneyhub and FreeAgent to support its mission to open finance for good.

It will see the secure sharing of financial data and trends with the specific purpose of achieving societal change and supporting the economy.

Part of the University of Edinburgh and in collaboration with the Financial Data and Technology Association (FDATA) and FinTech Scotland, it has already engaged in ground-breaking data work with NatWest Group.

Dame Julia explained: “Today’s announcement charts the considerable progress Smart Data Foundry has made to date in securing partnerships with these significant organisations which will enable us to unlock the power of financial data that, up until now, was not available for public purpose or common good.

“It is important not to underestimate the work that has gone into getting to this stage which includes data governance agreements to protect privacy.

“This headway, and the success of the NatWest Group partnership, paves the way for many other partnerships as we strive improve the lives of ordinary people and support the resilience of the SME sector.”

“Driven by our purpose to improve people’s lives, our new name, Smart Data Foundry, better reflects the challenges we face.

The announcement comes on the back of the successful pioneering partnership with NatWest Group. The high street bank shared de-identified data from over a million householders to provide a factual account of the impact of the pandemic on household finances, based on bank transactions.

To protect customer rights and privacy, all of the data was de-identified and analysed by accredited researchers in the security of the Smart Data Foundry Safe Haven, operated by EPCC at the University of Edinburgh, a controlled and secure service environment for undertaking data research.

Insights from the NatWest data were shared with the UK Government at the start of 2021 and continues to be updated. Simon McNamara, Group Chief Administrative Officer at NatWest said: “The pandemic continues to be challenging for many, and the impact is unique for each customer, household and business.

“By sharing data with Smart Data Foundry, organisations can collaborate to create better insights for the good of our communities so that we can better support their recovery. We have a crucial role, guided by our purpose, to support our customers and communities to get back on their feet and thrive”

Smart Data Foundry is also working with Moneyhub, the award-winning financial wellness FinTech, which covers spending trends in the UK economy to help with research into the financial impacts on citizens due to the pandemic.

Its partnership with FreeAgent will focus on SMEs, working with Equifax to investigate changes in credit worthiness and with Sage, to consider the causes and impact of late payments on small and medium sized businesses. The insights will be shared and continually updated with the UK Government as financial behaviour adapts to the pandemic environment. Aaron Harris, Chief Technology Officer at Sage added “Small and medium businesses have shown remarkable agility and resiliency over the last two years, but we know that late payments can have a devastating impact on their financial health and stability.